Are you stuck in an unending rat race and still can’t achieve financial freedom? Working hard for your company, chasing deadlines, yet still fighting to make ends meet? What if you could break away from this pattern and create a life in which money does not control your every decision? This blog provides a strategic framework for taking control of your finances and achieving financial freedom.

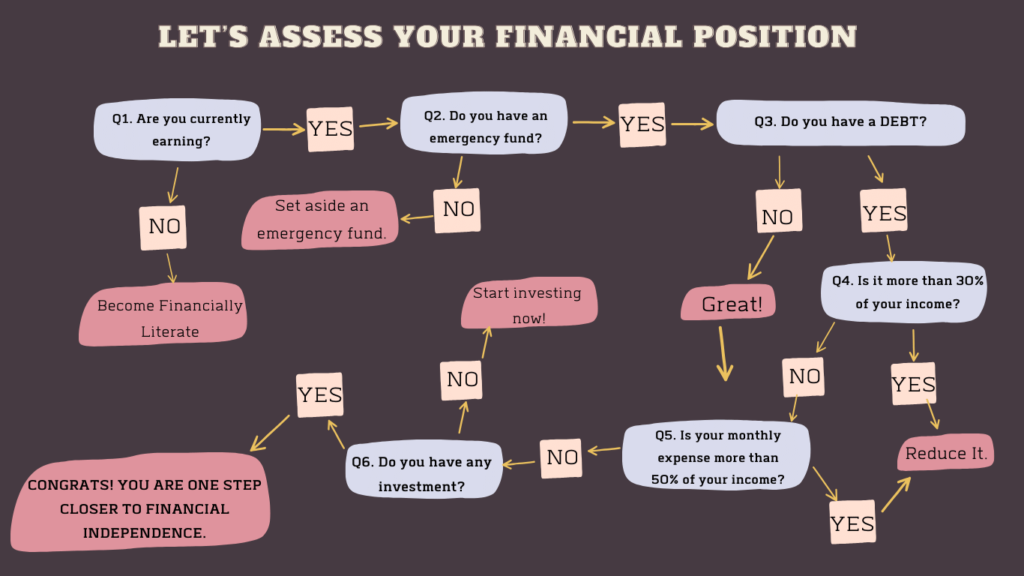

Before going on this journey, you should have a clear understanding of your existing financial situation. Ask yourself these important questions:

The first step towards financial freedom is to examine your existing financial situation. Start by assessing the stability of your money stream. Is your work stable, or do you rely on many income streams? Understanding the fundamentals of your financial stability is critical.

The income-to-expense ratio is an important indication of financial health. If your income does not cover your expenses, it is time to know why the problem is. Evaluate your expenses, and manage the unnecessary outflows. After evaluation, you can know whether you need to raise your income, reduce your expenses, or do both.

A well-planned Budget is your road map to financial freedom. When creating a budget, use the 50/30/20 rule: 50% for needs, 20% for debt reduction and savings, and 30% for wants. Maintain accurate records of your income and expenses. If you don’t have a budget, make one. If you have one, be sure it fits with your financial goals.

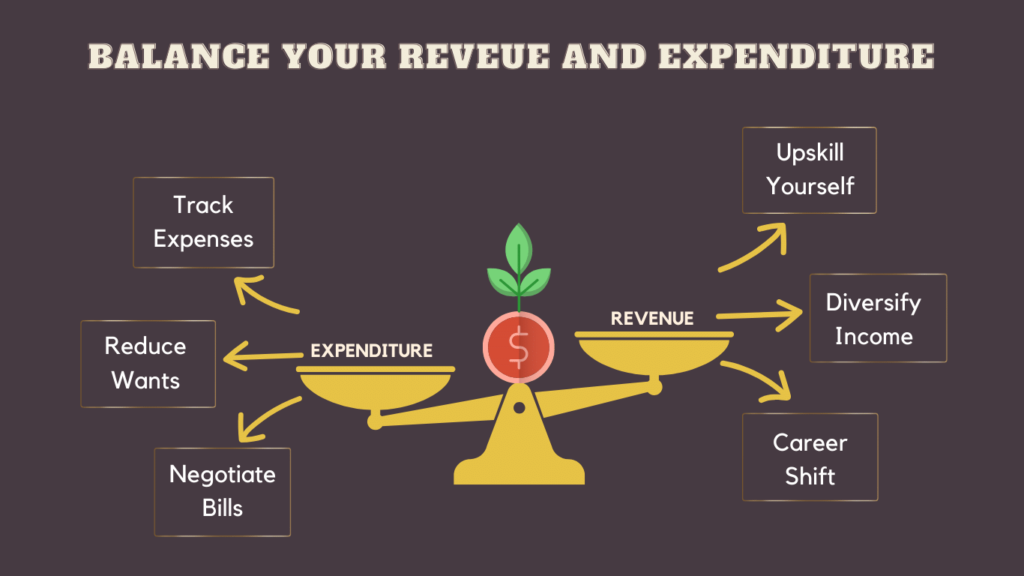

Financial freedom begins with balancing your revenue and expenditure. It is really important to keep a proper income-expense ratio to achieve financial freedom.

If your income is insufficient, consider the following options to increase it:

If your spending has gotten out of control, undertake a complete spending audit:

Saving and investing work transformational magic, making financial ambitions a reality. Each rupee saved builds the foundation for a secure future. Investing increases this magic, doubling your wealth and opening up new options. Consider the power of saving and investing; it is the formula that transforms dreams into wealth.

If saving seems difficult, don’t give up. Instead, do these:

Once you’ve established a healthy savings base, it’s time to consider investing:

Take a risk assessment test to see how comfortable you are with various investment options. This stage is essential for modifying your investing strategy to your financial personality and goals, resulting in a balanced and personalized approach to wealth accumulation.

Consult a financial advisor to get expert advice and create personalized investment plans. By using their expertise, you may manage the complexity of the financial world and optimize your investments for long-term success. A personalized approach guarantees that your plan is not only in line with your risk tolerance but also with your overall financial objectives.

Divide your assets among several investment categories, such as shares, bonds, and real estate. Diversification serves as a risk management approach by reducing the impact of market volatility on your entire portfolio. This strategy not only protects your money but also maximizes possible returns by capitalizing on diverse sectors and market circumstances.

Passive income streams are the key to ultimate financial freedom. These income sources involve less effort than the main income stream, but provide constant rewards, progressively releasing you from dependency on your major job.

Start small with low-risk options, such as high-yield savings accounts or peer-to-peer lending platforms. Enter into the field of financial growth by starting with low-risk investments. High-yield savings accounts provide a secure environment for your money, whilst peer-to-peer lending introduces you to the concept of earning interest on loans. This careful start provides a good basis for your future financial endeavors.

Diversify gradually by investing in dividend-paying equities, rental properties, or online businesses as you gain confidence. As your confidence grows, consider expanding your financial portfolio. Consider investing in different investment avenues like the stock market, bonds, FDs, etc. Gradual diversification guarantees a balanced approach to wealth accumulation.

Determine your first passive income goal and aim to increase it consistently over time. Define your financial destination by establishing specific and attainable goals. Set an initial passive income target that is consistent with your lifestyle goals. Over time, make steady progress towards exceeding these objectives, laying the groundwork for consistent and sustainable financial growth.

Achieving financial independence is a process, not a race. It requires time, work, and discipline. However, by properly controlling your income and expenses, rigorously saving and investing, and developing a variety of passive income streams, you may eventually escape the rat race and create a life of your own design. Financial independence entails more than just collecting wealth. It is about regaining control of your time and decisions.

The road to financial freedom gets smoother with deliberate decisions and planned action. By following this road map, taking control of your finances, and creating a secure future, you may escape the fast-paced lifestyle and embrace a life full of opportunities. Remember that you have the power to shape your own financial future. Begin your path today and watch the transforming force of financial independence take hold.

Feel free to ask about your queries or questions.

© 2024 – Finshala. All Rights Reserved