Do you want to become financially stable? If yes, you should take a personal finance planning course. People frequently consider their physical health, but have you ever wondered how your financial health is doing? Don’t worry, you can use our personal finance calculator to check this and adjust as needed based on your score.

The process of setting financial goals and creating a plan to reach those goals systematically is known as financial planning. It entails evaluating your earnings and expenditures and creating a thoughtful plan to optimize your wealth. There are two sorts of goals: short-term goals and long-term goals. To minimize any financial obstacles in your path, you should create a successful plan to accomplish both goals.

Personal finance planning is crucial because it enables you to take charge of your financial future and assists in managing your present financial position. It maintains a record of your expenditures to monitor your unnecessary spending. You can save yourself and maintain a well-structured plan to help you become financially secure in case of any unforeseen financial instability.

It ultimately results in a more stable and satisfying life by promoting independence, financial security, and the capacity to deal with economic uncertainties. People can improve their financial well-being, make wise decisions, and increase their savings through strategic planning.

Creating well-defined financial goals is one of the most important aspects of personal finance planning. Making wise choices regarding spending, investing, saving, and budgeting is difficult without guidance. When creating a personal finance plan, keep the following points in mind:

Start by focusing on your goals and objectives. What’s most important to you? Understanding your objectives is important whether you want to purchase a home, invest in your children’s school, or plan for a happy retirement. It helps connect your financial goals with your life aspirations.

Use the SMART framework to create financial goals that are specific, measurable, attainable, relevant, and time-bound. Instead of a general goal like “saving money,” set a particular goal like “saving 10% of your income for an emergency fund at the end of each month.”

Quantify your goals by assigning exact amounts and deadlines. Whether you’re paying off debt, saving for a home, or investing for retirement, having actual figures and deadlines helps you stay focused and accountable to your financial goals.

Make an emergency fund a top priority in your financial planning. This fund provides a financial cushion for unexpected expenses, ensuring that you do not lose your progress toward other goals due to unforeseen situations.

Regularly assess and change your financial goals as necessary. Life circumstances vary, and your financial goals should shift correspondingly. Regular assessment also allows you to recognize accomplishments and indicate areas where improvements may be required.

Whether you’re a young professional managing the challenges of the gig economy, or a family-oriented individual planning for your children’s future and retirement, these courses will be useful. In this part, we’ll look at some of the top free personal finance courses created for an Indian audience, focusing on the major modules, cultural concerns, and practical insights that make such courses essential for anyone trying to secure their financial future.

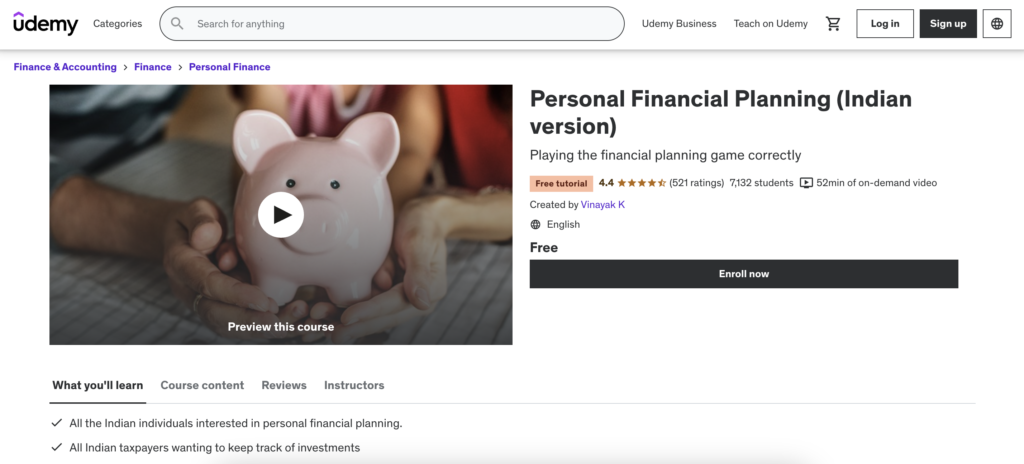

This course has been created for anyone who wants to develop an outstanding, practical understanding of personal finance, covering everything from taxes to credit cards. This course consists of 52 lectures totaling 3 hours in duration, during which you will learn everything you need to know about personal finance.

The course is a basic course for personal financial planning, including some simple and clear actionable actions to improve your finances. It comprises 22 lectures lasting around one hour. In this one-hour session, you will learn about the fundamentals of financial planning, the features and characteristics of all major investment options available in India, and much more.

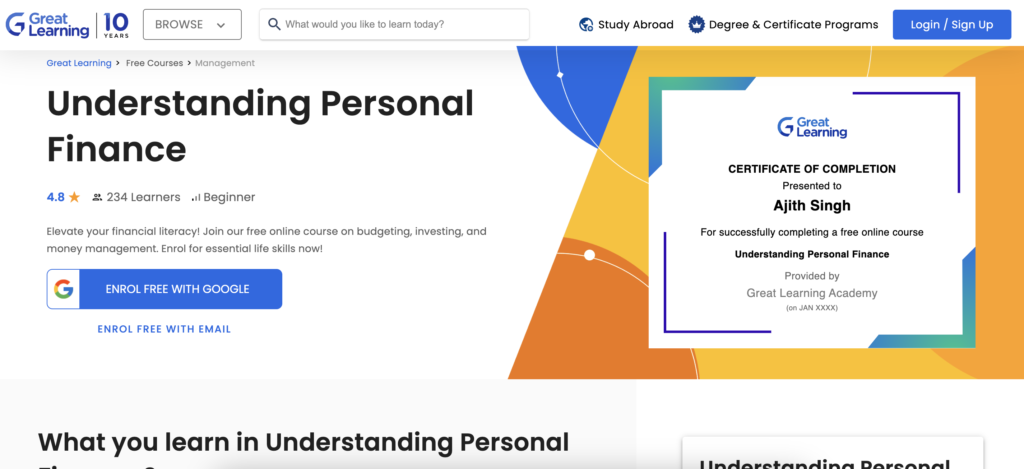

This course will help you achieve financial independence by teaching you about personal finance. It will teach you how to decode complex financial information by learning about financial statements. Importance of budgeting and financial planning to develop sensible financial habits and create attainable goals, providing a road map to financial security.

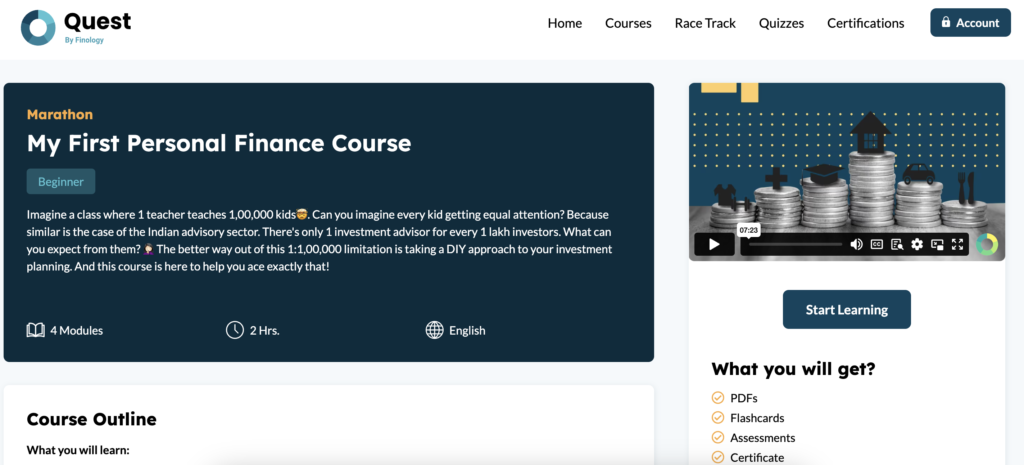

This course lets you identify your financial uniqueness and its requirements and solutions. It covers every actionable detail, concept, and strategy that can strengthen your finances and make you wealthy. It has four modules with a total duration of 2 hours, and you will surely learn all the basic and important principles of personal finances.

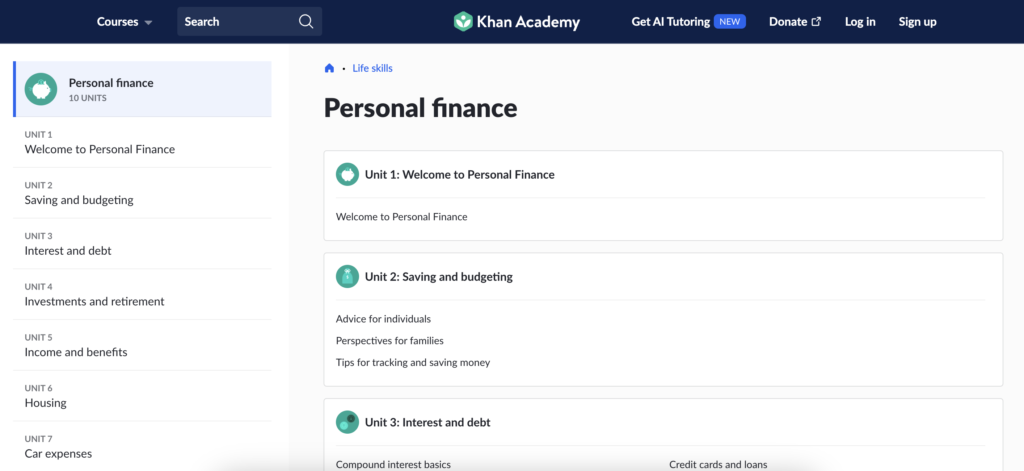

This course will teach you everything that you need to know while getting started in personal money management. It is divided into ten units, covering everything from saving and budgeting to tax management.

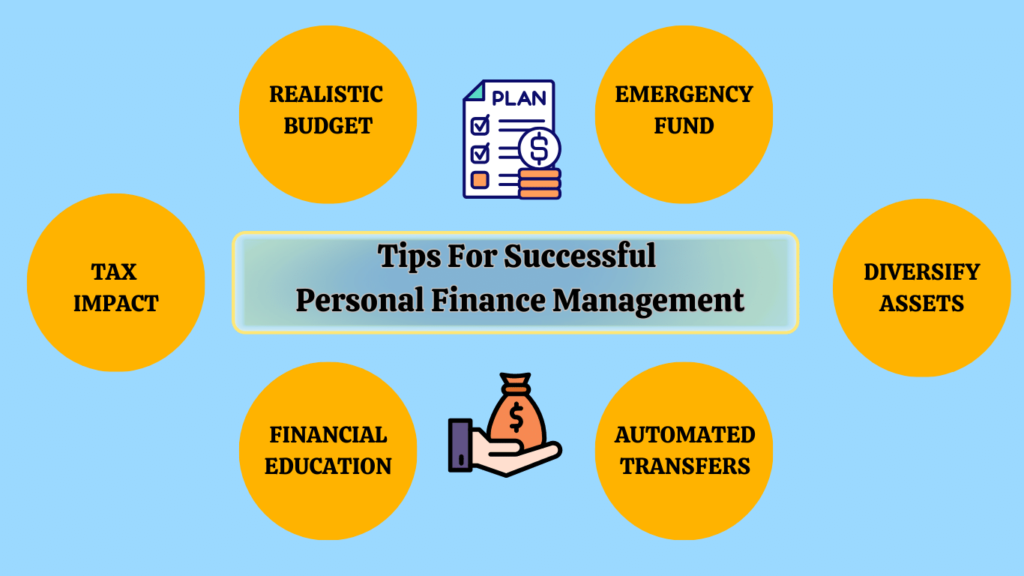

Understanding personal finance involves more than just information; it also necessitates a planned strategy and disciplined routines. The following are some actionable ideas and insights to help individuals on their way to successful personal money management. Whether you’re just getting started with financial planning or looking to improve your existing strategy, these suggestions provide practical advice for achieving and maintaining financial well-being:

In short, going on a personal finance planning journey is about more than just figures and charts; it’s about taking control of your financial destiny and creating a future that corresponds with your goals. Enrolling in a personal finance planning course is a critical first step toward financial empowerment. Remember that developing financial literacy is a constant effort. Continue to work on your understanding of budgeting, investing, and debt management. Check out our book, The Investor’s Sutra, and watch your financial goals convert from ambitions to successes.

Feel free to ask about your queries or questions.

© 2024 – Finshala. All Rights Reserved