Gold Investments 2024: Glittering Returns or Fool’s Gold?

The enticing nature of gold investments is still an increasingly hot topic among investors as 2024 approaches. But before you blindly buy into this precious metal, you should consider this important question: in today’s investment portfolios, is it fool’s gold or a route to glittering returns?

Glitter Returns In Gold Investment

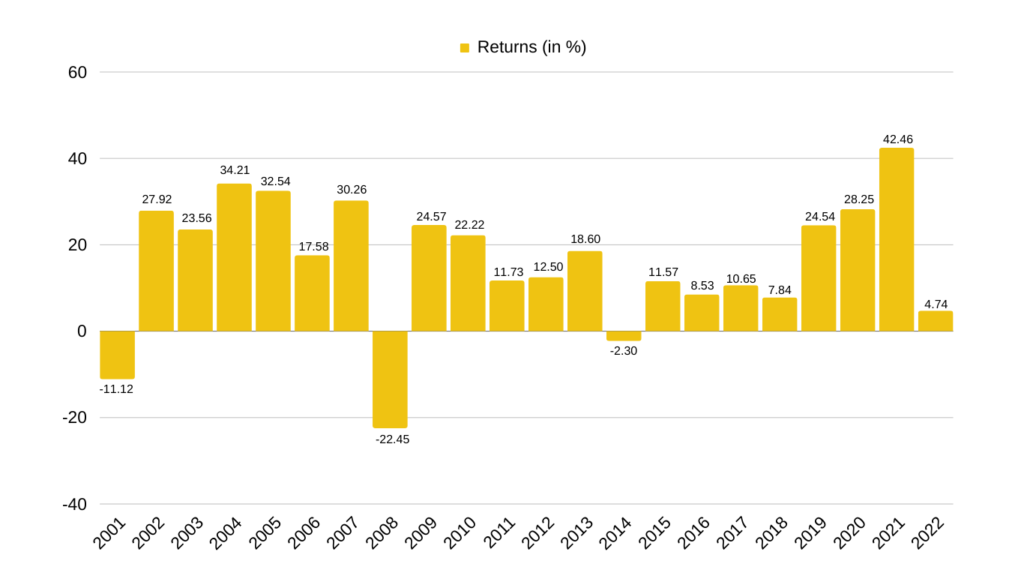

There is no denying the track record of gold as a safe-haven investment and inflation hedge. Over the past 20 years, gold has returned 11.2% on average, outpacing traditional fixed-income investments and frequently outperforming equities. Based on RBI data on the last 11 SGBs that saw redemptions, SGBs delivered an annual return of 17.35% plus 2.5% interest. Due to economic concerns and geopolitical unrest, gold prices increased gradually in 2023, giving investors some hope in an otherwise unstable market.

Understanding the Gold Investment Landscape

Investing in gold does not only mean investing in gold, it also includes gold bonds, gold ETFs, etc. There are several ways to invest in gold, and each has pros and cons of its own. Let’s see the main choices:

Physical Gold

Having gold jewelry, coins, or bars gives you a physical asset and a buffer against inflation. However, it is a bit complex to invest in them due to storage, insurance, and liquidity concerns.

Gold ETFs

Exchange-traded funds (ETFs) that track gold prices provide easy, affordable stock market investing. Although there is a lot of liquidity, the actual metal is not yours.

Gold Bonds

The government issues sovereign gold bonds, which are perfect for investors who are risk-averse because they guarantee returns and provide capital protection. Drawbacks could include shorter tenures and lower potential returns in comparison to actual gold.

Gold Mutual Funds

Investing in mutual funds with a gold concentration offers professional management and diversification, but there are also costs involved, including the possibility of tracking errors.

Gold Vs Other Investment Options

A basic comparison of gold investment and other well-liked investment options in India is given in this table. It’s important to remember that the details can change based on the state of the market at the time, particular products, and unique situations.

Investment Option |

Returns |

Risk |

Liquidity |

Investment Duration |

Tax Implications |

|---|---|---|---|---|---|

|

Gold |

Moderate; historically stable |

Low to Moderate; depends on market conditions |

High; easily tradable |

Suitable for both short-term and long-term |

Long-term capital gains tax is applicable after 3 years |

|

Equity Stocks |

High; depends on market performance |

High; subject to market volatility |

High; easily tradable in stock markets |

Best for long-term |

Long-term capital gains tax applicable after 1 year |

|

Real Estate |

High; depends on location and market trends |

High; subject to market and regulatory risks |

Low; selling property can be time-consuming |

Long-term; generally more than 5 years |

Long-term capital gains tax; benefits on home loan interest |

|

Fixed Deposits |

Low to Moderate; fixed interest rates |

Very Low; secured investments |

Moderate; premature withdrawal possible with penalty |

Ranges from few months to several years |

Interest is taxable; TDS applicable |

|

Mutual Funds |

Varies; can be high in equity funds, moderate in balanced funds |

Varies; higher in equity funds, lower in debt funds |

Moderate to High; depends on fund type |

Flexible; suitable for both short-term and long-term |

Equity funds taxed as per equity stocks, debt funds taxed as per income tax slab after 3 years with indexation |

Gold Investment: Risks and Challenges

We cannot dispute the fact that there are risks and difficulties associated with investing in gold, just as there are with any other investment. The following are a few of the risks that are listed:

- Price Volatility: Gold prices are subject to major fluctuations that could result in losses, particularly for investors with short-term goals. Recall that what seems bright today may seem dull tomorrow.

- Limited Income: Physical gold doesn’t produce any income; instead, it only makes money when its value increases, unlike stocks that do. This may pose a drawback for investors who are looking for consistent cash flow.

- Storage and Security Cost: Having physical gold increases the cost of the investment overall by requiring storage and insurance. Furthermore, secure facilities and regular monitoring are needed to preserve precious metals.

- Liquidity Issues: Especially in smaller towns or during market downturns, selling physical gold might not be as quick as selling stocks or ETFs.

Conclusion

Different forecasts for gold returns in 2024 are made by financial experts. While some warn about the opportunity costs of not investing in higher-yielding assets, others see growth potential and point to uncertainties in the world economy. Careful analysis and current information are essential for navigating the gold market. Financial advisors, investment applications, and market news are a few examples of tools that can offer the information needed to make wise choices when buying gold.

It might not be the best option for each scenario, but it can play a big part in a diversified portfolio. When entering the golden age of investing, investors should consider their financial objectives and risk tolerance.