- Home

- Stock Market

- Realistic Returns in 2024: What To Expect In Indian Stocks

Starting an investment journey in Indian stocks may be both exciting and challenging. It is critical to understand the landscape and have realistic expectations. Let’s dive into the world of investing, looking at prospective returns and tactics for a prosperous financial future. This blog is your guide to setting realistic expectations and embarking on a rewarding investment journey in the Indian stock market.

Investing in Indian stocks provides access to a dynamic market driven by varied industries. Before imagining profits, understand that Indian equities reflect the country’s economic growth, market trends, and worldwide impacts. The Indian stock market, which includes pillars such as the BSE and NSE, is a hive of activity. Diverse industries contribute to the market’s vitality, from technology to healthcare. Recognizing this landscape is the first step toward making informed investment decisions.

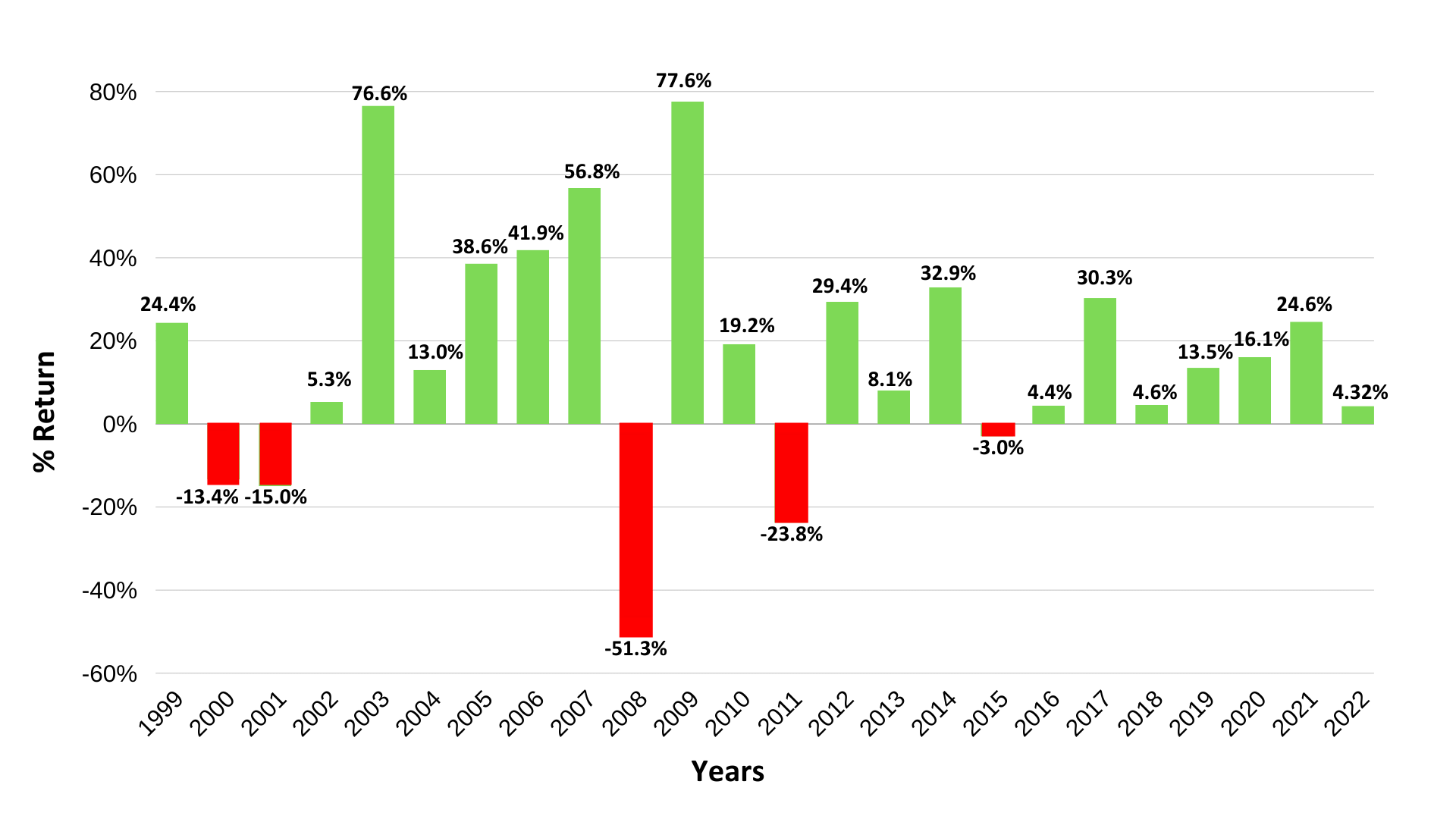

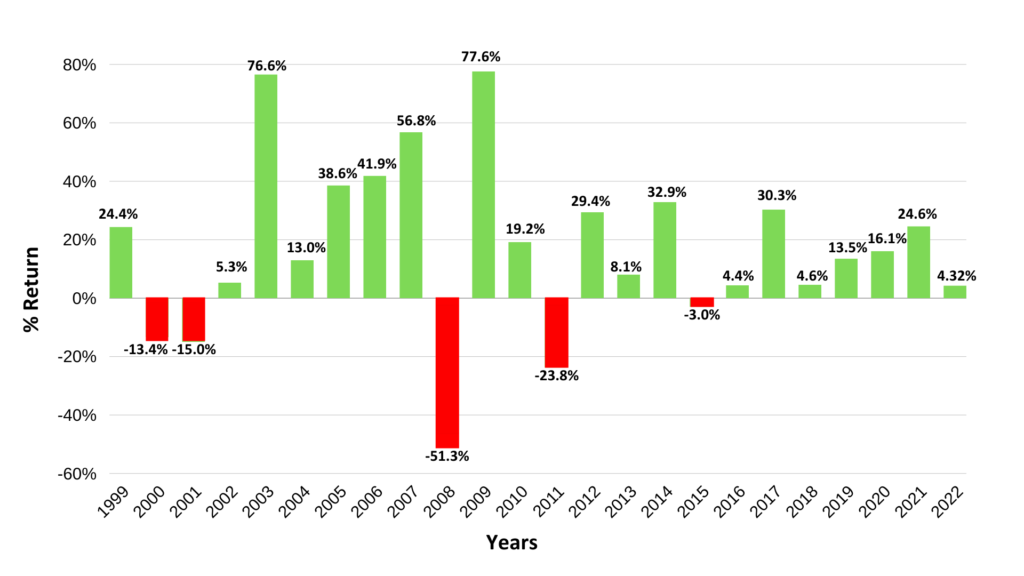

Although headlines advertising overnight billionaires and spectacular profits may have grabbed your interest, keep in mind that the Indian stock market is not a get-rich-quick plan. While the benchmark Nifty 50 has historically generated annual returns of roughly 12% (including dividends), this is neither a guarantee nor the standard for any individual investor.

Several factors that have an impact on your real returns:

It is important to be realistic instead of believing in unrealistic returns which can lead to disappointment and financial losses:

While thoughts of enormous profits are appealing, it is important to be realistic. Indian stocks have historically outperformed the market. Expecting constant, moderate returns is a prudent strategy.

Investors travel a path where risk and return co-exist. High potential profits are frequently accompanied by increased risk. Balancing these dynamics ensures that expectations are in line with market realities.

Diversifying your stock portfolio lowers your risk. Invest across industries and market capitalization to build a resilient portfolio that will protect you from the stock market’s volatility.

Patience is rewarded in Indian stocks. A long-term investing horizon allows you to ride out market changes while capitalizing on the power of compounding to achieve long-term growth.

Volatility is inherent. Cultivate emotional resilience, staying focused on your long-term goals despite short-term market fluctuations.

Investing in the Indian stock market has huge potential for wealth generation, but having reasonable expectations is essential for a successful trip. You may handle the inevitable volatility and achieve your financial goals by understanding market dynamics, and your risk tolerance, and developing a strategic approach. Remember that the keys to unlocking the actual potential of Indian stocks are patience, dedication, and continuous learning.

This blog is only the starting point for your financial journey. To keep growing on this path do follow Finshala and make an embarking journey. Go ahead, conduct research, analyze data, and make sound conclusions. The Indian stock market is waiting for you!

Feel free to ask about your queries or questions.

© 2024 – Finshala. All Rights Reserved

Passive Income Streams For 2024: Financial Freedom

[…] profitable source of passive income stream for 2024 is investing in the Indian share market. As the financial landscape changes, you can create a consistent income stream by making strategic […]