Investing for the Golden Years: Stocks and Retirement Planning

Do you have worries regarding your retirement? Do you have any plans for when you retire? Or do you want a proper plan to assist you in making your retirement life stress-free and relaxing? Don’t worry, you will get the answers to all of these questions in this blog. So keep reading till the end to find out how you can live a happy life without worrying about your retirement.

As we continue life’s journey, the golden years of retirement usually depict a picture of calm, relaxation, and pursuing passions. To ensure a financially secure and satisfying retirement, however, precise planning and intelligent investment selections are required. Stocks have emerged as a potent tool for wealth creation and long-term growth among the various investment options accessible, making them an essential component of a well-structured retirement plan.

Stock: Growth Drivers

Stocks, sometimes known as equities, indicate a company’s ownership. When you buy a stock, you effectively become a part-owner of the firm, entitled to a portion of its income and assets. Stocks can potentially make huge long-term profits as companies grow and expand their operations.

Stocks are an appealing investment option for retirement planning. Their growth potential allows individuals to acquire wealth that can give them financial security and support their preferred lifestyle throughout their senior years.

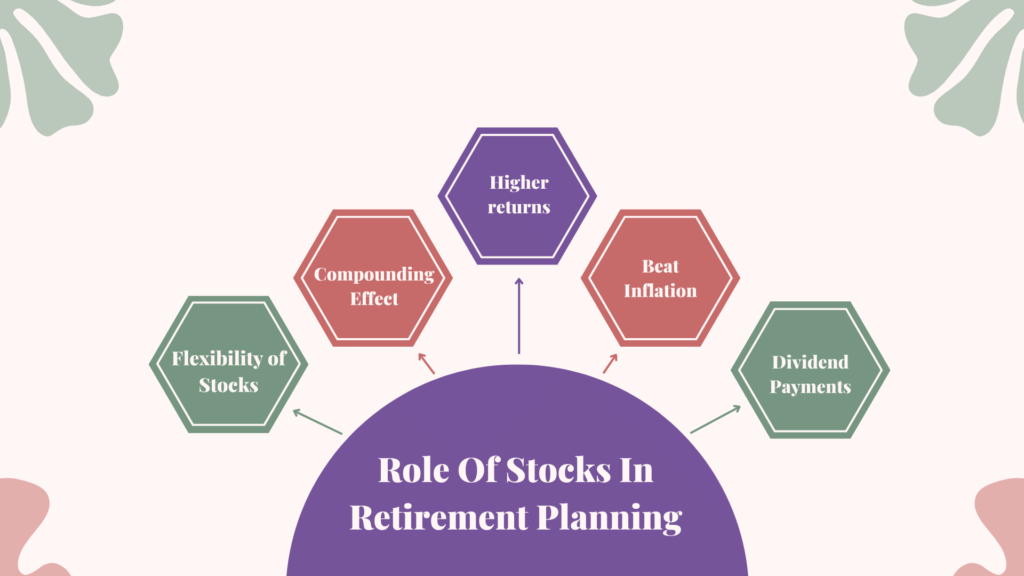

Stocks play an important part in relieving the burden of retirement planning by providing significant avenues for wealth generation, growth, and income. Here’s how stocks can help you live a stress-free retirement:

- Historically, compared to many other investment options, stocks have the potential to yield higher returns.

- The impact of compounding becomes more noticeable the longer your investment horizon is, which relieves pressure to accumulate a sizable amount rapidly.

- Investing in things that may beat inflation increases the chance that your money will gain value when you retire when preserving purchasing power is essential.

- A steady income stream is provided by the frequent dividend payments made by many stocks. By providing a steady stream of income, dividends may reduce the need to sell assets to raise money.

- The flexibility of stocks allows you to gradually refine your retirement plan through asset reallocation, risk tolerance adjustments, and market conditions.

Investment Options In Stocks For Retirement Planning

There are several stock investment options available in India that are appropriate for retirement planning. When choosing the best options, it’s critical to take into account variables like risk tolerance, investment horizon, and financial goals. The following are various stock investing choices for India’s retirement planning:

INVESTMENT OPTIONS |

DEFINITION |

INTEREST RATE |

TIME HORIZON |

|---|---|---|---|

|

Direct Stock Investment |

Investment funds are pooled and used to buy a variety of stocks. Supervised by qualified fund managers, offering investors exposure to a variety of stocks. |

10% |

Long-term (5+ years) |

|

Equity Mutual Funds |

Acquiring individual stocks of particular companies directly from the stock market enables investors to construct a personalized portfolio according to their tastes and research. |

12% -15% |

Long-term (5+ years) |

|

Blue-Chip Companies |

ETFs that mimic the performance of blue-chip stocks—shares of massive, respectable businesses with a track record of dependability and stability in their finances. |

8% |

Long-term (5+ years) |

|

Dividend Stocks |

Stocks of businesses that give shareholders a consistent stream of income by distributing a portion of their earnings as dividends on a regular basis. |

5% |

Long-term (5+ years) |

|

Index Funds |

Mutual funds, also known as exchange-traded funds (ETFs), are financial instruments intended to mimic the returns and composition of a particular market index. |

10% |

Long-term (5+ years) |

|

SIP |

A systematic approach to mutual fund investing in which participants make regular, monthly, or quarterly contributions of a set amount as opposed to making a single, large investment. |

10% |

Long-term (5+ years) |

|

PPF |

A 15-year fixed investment period government-backed savings plan in India that offers guaranteed interest rates and tax benefits. |

7.1% |

15 years |

|

NPS |

A long-term, voluntary retirement savings plan that encourages systematic saving. NPS is administered by the PFRDA and offers a combination of debt and equity investments. |

10% |

60 years |

|

ETFS |

ETFs that resemble the performance of blue-chip stocks—shares of massive, respectable businesses with a track record of dependability and stability in their finances. |

10% |

Long-term (5+ years) |

Please note: These are just average rates and actual returns may vary significantly based on various factors.

Conclusion

In conclusion, a strategic financial plan is just as important as dreams for successfully navigating the golden years of retirement. As active drivers of growth, stocks become essential for ensuring a comfortable retirement. They are the foundations of financial security due to their historical potential for higher returns, compounding benefits, and resistance to inflation. People can make necessary adjustments to their retirement plans because stocks are flexible.

Careful consideration of risk, horizon, and goals is essential when evaluating particular investment options in India. Although there are differences in interest rates and time horizons, long-term financial stability is always possible. It serves as a reminder that making wise and well-thought-out stock investments is the first step toward a stress-free retirement. Plan wisely, and invest diligently!

Do follow our social media accounts for more such valuable information:

Tianna Carter

hello!,I like your writing very so much! proportion we keep up a correspondence extra approximately your post on AOL? I need an expert in this space to unravel my problem. May be that is you! Taking a look forward to see you.