Mutual funds have become an increasingly popular choice among the wide range of investing options available to novice and experienced investors. The benefits of investing in mutual funds make them a desirable choice for building wealth in addition to financial gains. We’ll explore the main reasons why investing in mutual funds is a wise choice and some of the top mutual funds companies in this blog.

Mutual funds are a popular kind of investing that combines the capital of numerous individuals to buy a range of securities, including bonds, stocks, and other assets. The best mutual funds are overseen by qualified fund managers, and provide investors with the chance to access a professionally managed and diversified portfolio even with a minimal investment.

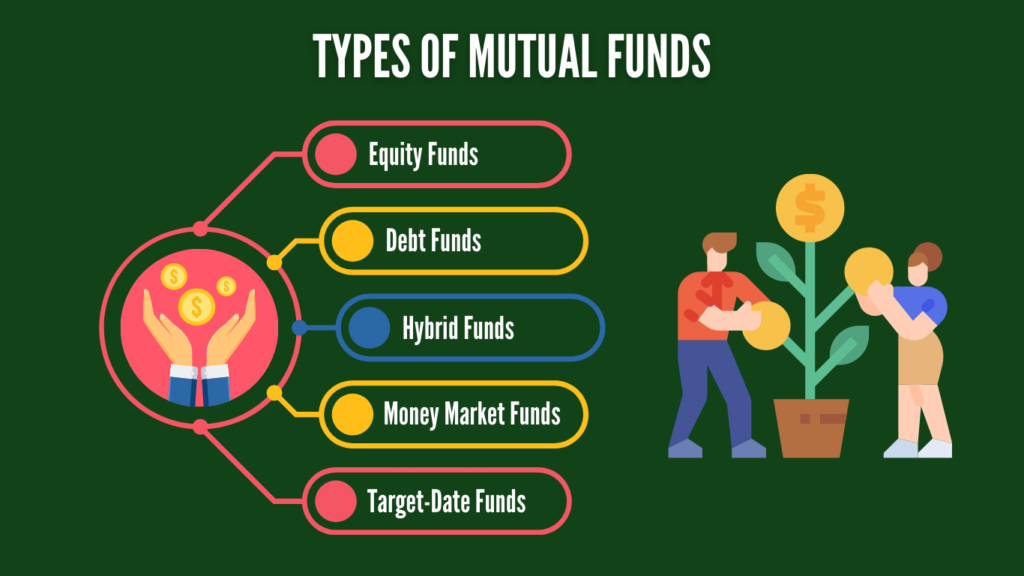

There are various types of mutual funds, these are the well-known options:

Selecting the best mutual funds to invest can help you get the most out of your investment. The following are five top mutual funds companies, which are high-return mutual funds renowned for their reliability and performance. These are some high-return mutual funds:

One of the biggest and most established mutual fund organizations in India is SBI Mutual Fund, a subsidiary of the State Bank of India. Well-known for offering a wide variety of funds to suit different risk tolerances, SBI Mutual Fund places a strong emphasis on investor education and transparency.

Leading asset management firm in India, ICICI Prudential Mutual Fund is a joint venture between ICICI Bank and Prudential Plc. Offering a wide range of products covering equities, debt, and hybrid categories, it is renowned for its originality and customer-centric methods.

One of India’s top mutual fund companies is HDFC Mutual Fund, a division of Housing Development Finance Corporation Limited. HDFC Mutual Fund offers a wide range of investment alternatives and is known for its strong risk management and emphasis on long-term wealth growth.

Aditya Birla Sun Life Mutual Fund is renowned for its broad range of fund options and client-focused philosophy. To provide investors with the information they need to make wise investment decisions, the fund house places a strong emphasis on innovation and investor education.

Kotak Mahindra Mutual Fund is renowned for prioritizing value delivery to investors via careful fund management. The fund company combines financial knowledge with a dedication to moral and open business methods, offering a wide variety of funds covering different asset classes.

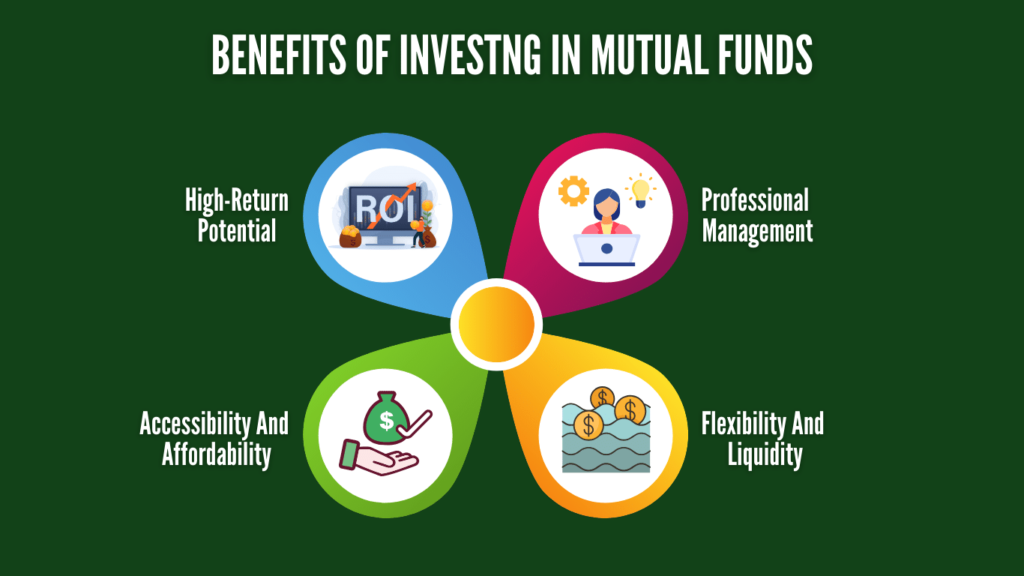

Mutual funds offer a wide range of benefits that meet the different requirements and interests of investors. The main advantage is diversification. By combining funds from numerous participants, mutual funds construct a portfolio that spreads across several asset classes.

One of the main factors that make mutual funds appealing is the mutual fund interest rate. These high-return mutual funds give clients access to professionally managed portfolios, enabling them to benefit from fund managers’ experience.

Mutual funds are run by seasoned professionals, as opposed to individual investors who might not have the time or knowledge to manage their portfolios well. To maximize the performance of the fund, these fund managers carry out in-depth market research and analysis and make well-informed recommendations.

Mutual fund investing is incredibly affordable. The financial markets are accessible to even those with minimal resources because of the comparatively low investment requirement. Because of their cost, mutual funds are a flexible investment choice that appeals to a wide range of investors.

Mutual funds provide investors with unmatched flexibility in selecting funds that correspond with their risk tolerance and financial objectives. Mutual fund liquidity also makes it simple for investors to access their invested capital by allowing them to buy or sell units at the current Net Asset Value (NAV).

In a nutshell, the benefits of investing in mutual funds make them an appealing option for anyone looking for a well-rounded investing approach. When it comes to investing options, mutual funds are particularly flexible and easily accessible for those who want to gradually increase their money. In addition to expert management and diversification, mutual funds’ interest rate offers high interest that contributes to long-term wealth creation.

Feel free to ask about your queries or questions.

© 2024 – Finshala. All Rights Reserved